Dit onderzoeksrapport over de economie van Bitcoin – Bitcoin economics – , is uitgegeven geworden door BitMEX. Het gaat over de economische werking ofwel economische principes van Bitcoin. Deze worden vergeleken met het huidige monetaire systeem van kredietexpansie, de werking van fiduciair geld en de kritiek van reguliere economen op de Bitcoin. Het rapport vertrekt vanuit een beschrijving van de werking van het huidige bancaire systeem gebaseerd op fractioneel bankieren en kredietexpansie door de centrale banken op basis van geldverruimingsprogramma’s.

Dit onderzoeksrapport over de economie van Bitcoin – Bitcoin economics – , is uitgegeven geworden door BitMEX. Het gaat over de economische werking ofwel economische principes van Bitcoin. Deze worden vergeleken met het huidige monetaire systeem van kredietexpansie, de werking van fiduciair geld en de kritiek van reguliere economen op de Bitcoin. Het rapport vertrekt vanuit een beschrijving van de werking van het huidige bancaire systeem gebaseerd op fractioneel bankieren en kredietexpansie door de centrale banken op basis van geldverruimingsprogramma’s.

[toc]

Dynamics of credit expansion

The core characteristic of the traditional banking system and modern economies is the ability of the large deposit taking institutions (banks) to expand the level of credit (debt) in the economy, without necessarily needing to finance this expansion with reserves. An often poorly understood point in finance, is the belief that banks require reserves, liquidity or “cash”, to make new loans. After-all where do banks get the money from? It is true that smaller banks and some financial institutions do need to find sources of finance to make new loans. However, in general, this is not the case for the main deposit taking institutions within an economy. If a main deposit taking institution, makes a new loan to one of their customers, in a sense this automatically creates a new deposit, such that no financing is required. This is because the customer, or whoever sold the item the loan customer purchased with the loan, puts the money back on deposit at the bank. Therefore, the bank never needed any money at all. Indeed, there is nothing else people can do, the deposits are “trapped” inside the banking system, unless they are withdrawn in the form of physical notes and coins, which rarely happens nowadays.

Please consider the following simplified example:

1. A large bank, JP Morgan, provides a mortgage loan to a customer, who is buying their first home, for $500,000

2. JP Morgan writes a check to the mortgage customer for $500,000

3. The mortgage customer deposits the check into his deposit account, at JP Morgan

4. The mortgage customer writes a new check, for $500,000 and he hands it over to the seller of the property

5. The seller is also banking client of JP Morgan and as soon as she receives the check, she deposits it into her JP Morgan bank account

As one can see, the above process had no impact on the bank’s liquidity or reserves, the bank never had to spend any “cash” at any point in the above example. Of course, the seller of the property does not necessarily have to have an account with the same bank as the one which provided the loan. However large deposit taking institutions, such as JP Morgan, HSBC or Bank of America, have large market shares in the deposit taking business, in their local markets. Therefore, on average, these large banks expect more than their fair share of new loans to end up on deposit at their own

bank. Actually, on average, new loans in the economy increases the liquidity for these large banks, rather than decreasing it.

The accounting treatment of this mortgage, for the bank, is as follows:

• Debit: Loan (asset): $500,000

• Credit: Deposit (liability): $500,000

The bank has therefore increased its assets and liabilities, resulting in balance sheet

expansion. Although from the point of view of the home seller, she has $500,000 of cash. The above transaction has increased the amount of loans and deposits in the economy. From the customer’s point of view, these deposits are seen as “cash”. In a sense, new money has been created from nothing, apart from perhaps the asset, which in this case is the property. In the above scenario, M0 or base money, the total value of physical notes and coins in the economy, as well as money on deposit at the central bank, remains unchanged. M1, which includes both M0 and money on deposit in bank accounts, has increased by $500,000. Although the precise definition of M1 varies by region. Cash reserves from the point of view of a bank are physical notes and coins, as well as money on deposit at the central bank. The ratio between the level of deposits a bank can have and its reserves, is called the “reserve requirement”. This form of regulation, managing the reserve requirement, leads to the term “fractional reserve banking”, with banks owing more money to deposit customers than they have in reserves. However, contrary to conventional wisdom, in most significant western economies, there is no regulation directly limiting the bank’s ability to make these loans, with respect to its cash reserves. The reserve requirement ratio typically either does not exist, or it is so low that it has no significant impact. There is however a regulatory regime in place that does limit the expansionary process, these are called “capital ratios”. The capital ratio is a ratio between the equity of the bank and the total assets (or more precisely risk weighted assets). The bank can therefore only create these new loans (new assets) and therefore new deposits (liabilities) if it has sufficient equity. Equity is the capital investment into the bank, as well as accumulated retained earnings. For example, if a bank has $10 of equity, it may only be allowed

$100 of assets, a capital ratio of 10%.

The credit cycle

To some extent, the dynamic described above allows banks to create new loans and expand the level of credit in the economy, almost at will, causing inflation. This credit cycle is often considered to be a core driver of modern economies and a key reason for financial regulation. Although the extent to which the credit cycle impacts the business cycle is hotly debated by economists. These dynamics are often said to result in expansionary credit bubbles and economic collapses. Or as Satoshi Nakamoto described it:

“Banks must be trusted to hold our money and transfer it electronically, but

they lend it out in waves of credit bubbles with barely a fraction in reserve.”

– Satoshi Nakamoto

The view that the credit cycle, caused by fractional reserve banking, is the dominant driver of modern economies, including the boom and bust cycle, is likely to be popular in the Bitcoin community. This theory is sometimes called Austrian business cycle theory, although many economists outside the Austrian school also appreciate the importance of the credit cycle. However, there are alternative views. For example, another successful investment firm, Marathon Asset Management, identifies the “capital cycle” as the main driver of the business cycle, rather the credit cycle. In their view a cycle emerges with respect to investment in production.

The fundamental cause of the credit expansionary dynamic

The above dynamic of credit expansion and fractional reserve banking is not understood by many. However, with the advent of the internet, often people on the far left politics, the far right of politics or conspiracy theorists, are becoming partially aware of this dynamic, perhaps in an incomplete way. With the “banks create money from nothing” or “fractional reserve banking” narratives gaining some traction. The question that arises, is why does the financial system work this way?

This underlying reasons for this, are poorly understood, in our view.

Individuals with these fringe political and economic views, may think this is some kind of grand conspiracy by powerful elite bankers, to ensure their control over the economy. For example, perhaps the Rothschild family, JP Morgan, Goldman Sachs, the Bilderberg Group, the Federal Reserve or some other powerful secretive entity deliberately structured the financial system this way, so that they could gain some nefarious unfair advantage or influence? This is not at all the case .

The ability of deposit taking institutions to expand credit, without requiring reserves, is the result of inherent characteristics of the money we use and the fundamental nature of money. This is because people and businesses psychologically and for very logical practical reasons, treat bank deposits in the same way as “cash” when they could alternatively be considered as loans to the bank. This enables banks to then expand the amount of deposits, knowing they are safe, as customers will never withdraw it, since they already think of it as cash.

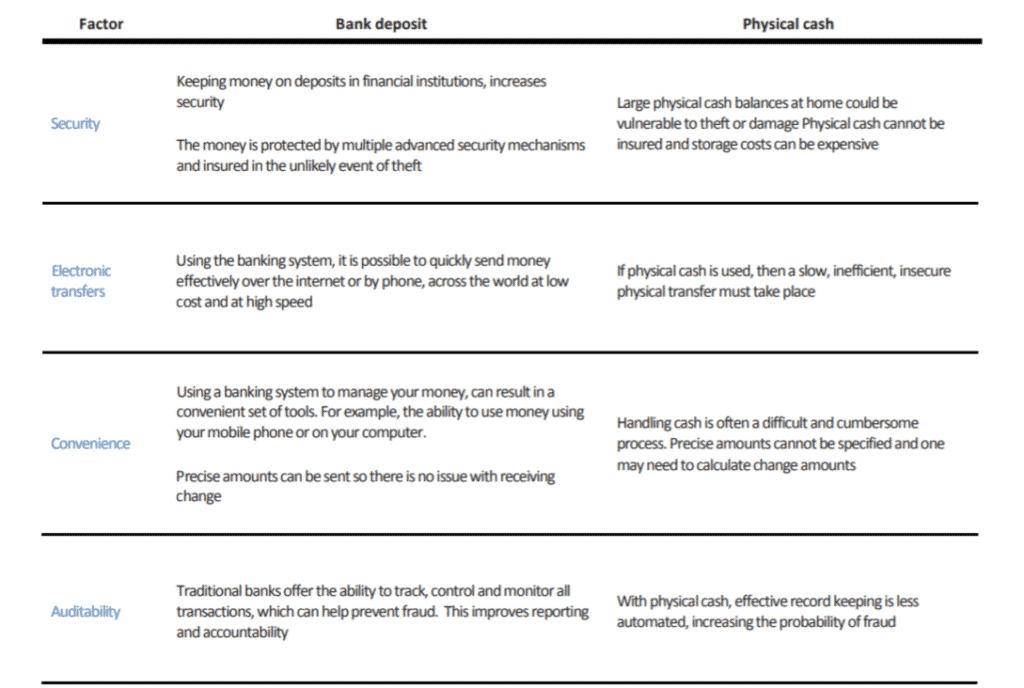

Bank deposits are treated this way for perfectly reasonable and logical reasons, in fact bank deposits have some significant advantages over physical cash. Bank deposits are simply much better than physical cash. It is these inherent and genuine advantages that cause fractional reserve banking, not a malicious conspiracy, as some might think.

Advantages of bank deposits compared to physical notes and coins

The main features of the different types of money

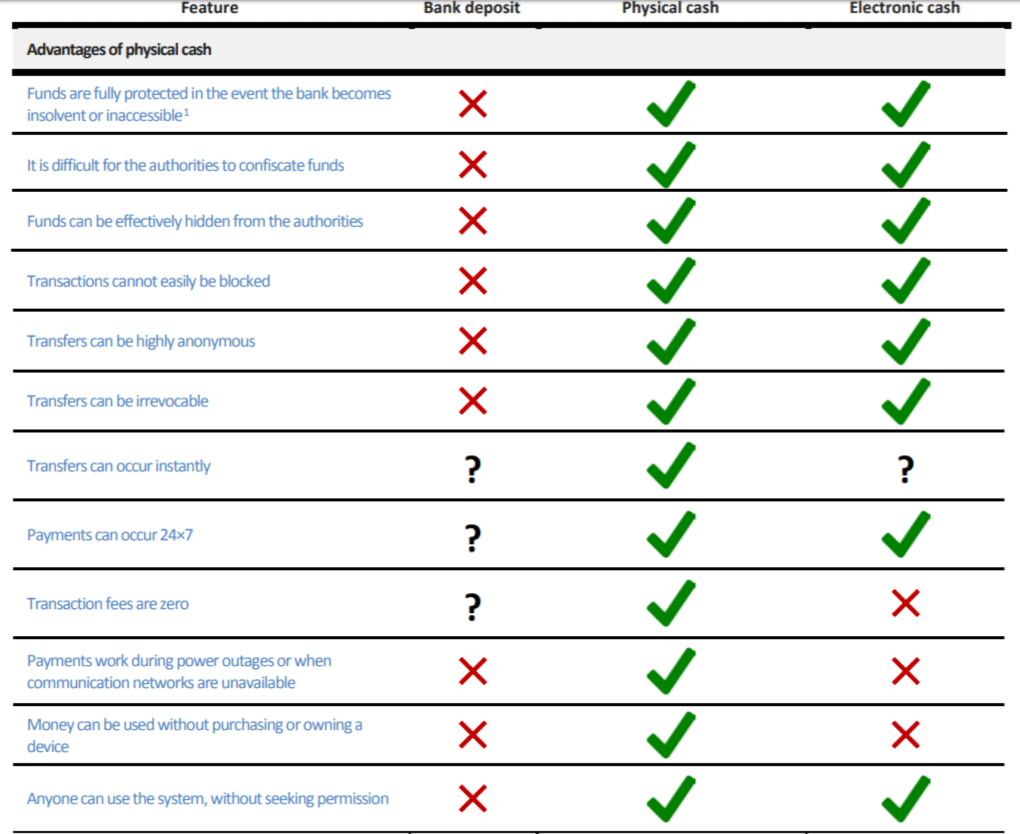

Despite the strong advantages of bank deposits mentioned in part 1 of this piece, namely the ability to use it electronically, physical notes and coins do have some significant benefits over electronic money. The following table aims to summarize the main features of the different types of money, bank deposits, physical cash and Electronic Cash (Bitcoin).

The unique properties of Bitcoin

Bitcoin shares many of the advantages of physical cash over electronic bank deposits. Although Bitcoin does not have the full set of advantages, as the table above demonstrates. However, the key unique feature of Bitcoin, is that it has both some of the advantages of physical cash and the ability to be used electronically.

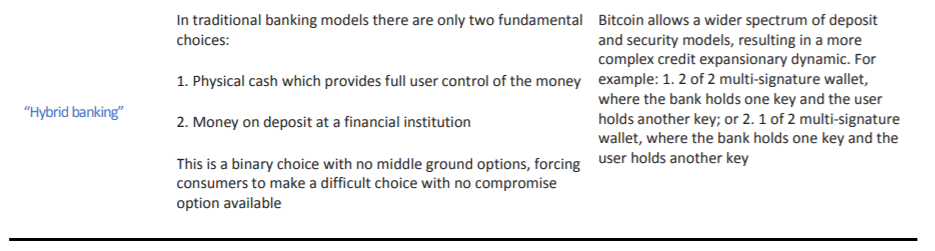

Bitcoin aims to replicate some of the properties of physical cash, but in an electronic form, an “electronic cash system”. Before Bitcoin, people had to make a binary choice, between physical cash or using a bank deposit. Although technically physical cash is a kind of a bank deposit, a deposit at the central bank, physical cash still has unique bearer type properties which could not be replicated in an electronic form. For the first time ever, in 2009, Bitcoin provided the ability to use a bearer type asset, electronically. Bitcoin can be thought of as a new hybrid form of money, with some of the advantages of physical cash, but also some of the advantages of bank deposits

Bitcoin’s limitations Although Bitcoin has inherited some of the strengths of both traditional electronic money systems and physical cash. Typically, Bitcoin does not have all the advantages of either electronic money or physical cash, however it is uniquely positioned to be able to have subset of the features of

each. This provides a new middle ground option. For example, Bitcoin may never have the throughput of traditional electronic payment systems or the ability to use without electricity such as with physical cash. Although as technology improves, Bitcoin may slowly develop more strengths and gradually improve its capabilities, to narrow the

gap.

The implications of these characteristics on credit expansion Understanding the dynamics of these characteristics, can be useful in evaluating the potential economic significance of Bitcoin, should the ecosystem grow. Bitcoin has at least six properties

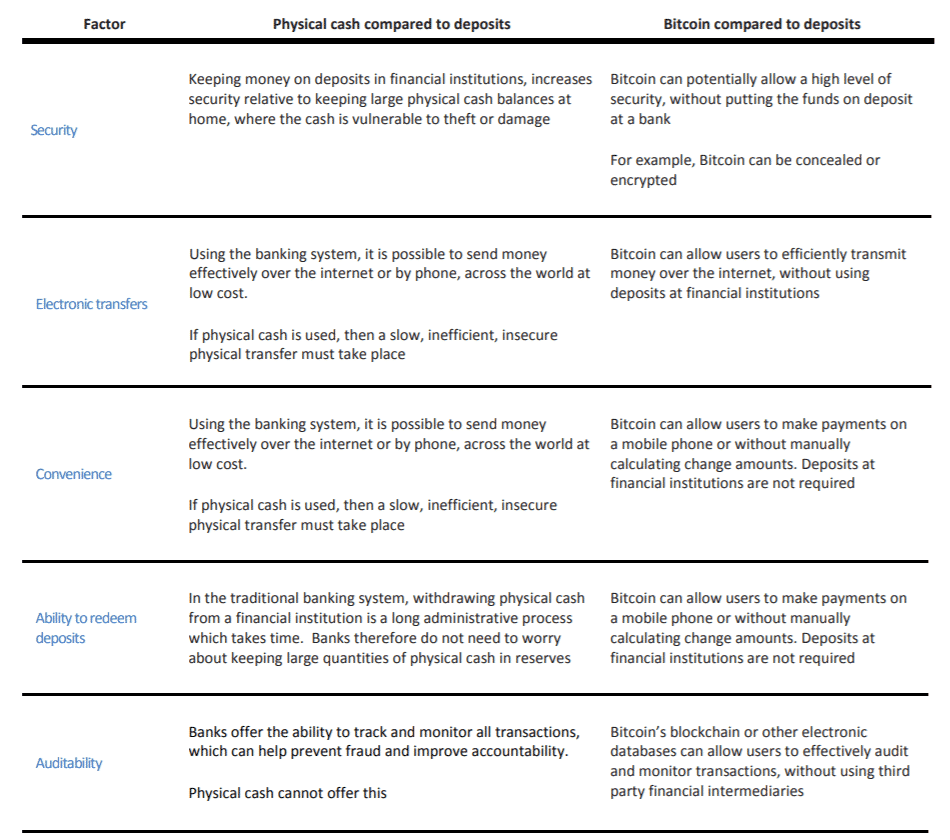

which provide some level of natural resilience against credit expansion, which traditional money does not have. This is because the advantages of keeping money on deposit at a bank are not always as pronounced in Bitcoin, compared to the alternatives. However, Bitcoin is certainly not immune to the same credit expansionary forces which exist in traditional systems, indeed people can keep Bitcoin on deposit at financial institutions just like they can with physical cash. Bitcoin may merely have greater resistance to the same credit expansionary forces. At the core of our reasoning, is looking the advantages of bank deposits compared to physical cash,

which are the characteristics that enable large banks to freely expand credit and evaluating to what extent they apply in Bitcoin. As the table below shows, the advantages of keeping money on deposit at a bank are less significant in the Bitcoin world, therefore we think Bitcoin does have some unique resilience against the forces of credit expansion.

Physical cash vs bank deposits compared to Bitcoin vs Bitcoin deposits

The economic consequences of less credit expansion

The consequences of the lower level of credit expansion this analysis implies, does not really say much about whether this potentially new economic model will be more beneficial to society, nor does it say much about whether Bitcoin will be successful or not. The former is something that has been heavily debated by economists for decades and the latter is a separate topic, in our view. Although, despite decades of economic debate, perhaps Bitcoin is sufficiently different to the money which came before it, such that the debate is required again, with new very different information. For example, inflation or deflation, caused by cycles of credit expansion, may have very different consequences in a Bitcoin based financial system, than on one based on bank deposits and debt. A key problem with deflation in a debt-based money system, is that it increases the real value of debt, resulting in a downwards economic spiral. For non-debt-based money systems like Bitcoin, it is less clear what the implications of deflation are. Although Bitcoin may not necessarily result in a superior economic model, we think this analysis may suggest that Bitcoin may have some properties that make the economic model somewhat unique or perhaps interesting, compared to the possible models that came before it. Therefore, it does look like an area worth examining.

To many, the ultimate objective of Bitcoin is to become sufficiently dominant, such that there is a significant decrease in credit expansionary forces, which can neutralize the credit cycle and therefore the business cycle. Although, this should be considered as an extremely ambitious objective, which we consider as extremely unlikely. And even in the remarkable circumstance that Bitcoin grows to this scale, other unforeseen economic problems may emerge.

Bitcoin’s Deflation Problem

One of the most common critiques of Bitcoin and related crypto-coin systems, is the supply cap (in the case of Bitcoin 21 million) and the associated deflationary nature of the system, which could be damaging to the economy. Critics have argued that history has taught us that a finite monetary supply can be a poor economic policy, resulting in or exacerbating, economic crashes. Either because people are unwilling to spend appreciating money or because the real value of debt increases, resulting in a highly indebted economy. Bitcoin proponents are often called “economically naive”, for failing to have learnt these economic lessons of the past. In this third piece on Bitcoin economics, we explain that the situation may be more complex than these critics think, as Bitcoin is fundamentally different to the types of money that came before it.

There may be unique characteristics about Bitcoin, which make it more suited to a deflationary policy. Alternatively, limitations or weaknesses in Bitcoin could exist, which mean that too much inflation could have negative consequences not applicable to traditional forms of money. In our view, these issues are often overlooked by some of Bitcoin’s economic critics.

A selection of quotes about Bitcoin’s inflation problem

“The supply of central bank notes can easily expand and contract. For a

positive demand shock to bank notes (shifting from

consumption/investment to money: i.e. it is a deflationary shock), the central

bank increases money supply by buying securities and foreign currencies.

For a negative demand shock to bank notes, the central bank absorbs

money in circulation by selling securities and other assets. In case of [Bitcoin],

the latter operation is not included in its protocol. That is to say, the

cryptocurrency protocol usually includes the currency supply rule, but does

not have a currency absorption or write-off protocol. Can we reduce this

irreversibility?” – Mitsuru Iwamura (“Can We Stabilize the Price of a Cryptocurrency?:

Understanding the Design of Bitcoin and Its Potential to Compete with Central

Bank Money”) – 2014

“The point is that by not building in an inflation, of say 2% per annum in the

global supply of Bitcoins, you almost doom it as a currency, because people will

start hoarding it, knowing that it’s going to be worth more next year than it is

this year” – David Webb (51 minutes into the video) – 2014

“More broadly, a hard supply cap or built-in deflation is not an inherent

strength for a would-be money. A money’s strength is in its ability to meet

society’s needs. From my perspective, Bitcoin’s built-in deflation means that it

does a poorer job than it might at meeting society’s needs. Maybe I will be

proven wrong. We shall see.” – The Economist (“Bitcoin’s Deflation Problem”) – 2014

“The currency’s “money supply” will eventually be capped at 21m units. To

Bitcoin’s libertarian disciples, that is a neat way to preclude the inflationary

central-bank meddling to which most currencies are prone. Yet modern central

banks favour low but positive inflation for good reason. In the real world wages

are “sticky”: firms find it difficult to cut their employees’ pay. A modicum of

inflation greases the system by, in effect, cutting the wages of workers whose

pay cheques fail to keep pace with inflation. If the money supply grows too

slowly, then prices fall and workers with sticky wages become more costly.

Unemployment tends to rise as a result. If employed workers hoard cash in

expectation of further price reductions, the downturn gathers momentum.”

– The Economist (“Money from Nothing”) – 2014

“Our current global system is pretty crap, but I submit that Bitcoin is worst. For

starters, BtC is inherently deflationary. There is an upper limit on the number

of bitcoins that can ever be created (‘mined’, in the jargon: new bitcoins are

created by carrying out mathematical operations which become progressively

harder as the bitcoin space is explored—like calculating ever-larger prime

numbers, they get further apart). This means the cost of generating new

Bitcoins rises over time, so that the value of Bitcoins rise relative to the

available goods and services in the market. Less money chasing stuff; less cash

for everybody to spend (as the supply of stuff out-grows the supply of money).”

– Charlie Stross (“Why I want Bitcoin to die in a fire”) – 2013

“Nevertheless, there is still the 21m limit issue. If the limit isreached, the future

of Bitcoin supply has to go down the path of fractional reserve banking, since

only re-lending existing coin, or lending on the basis that settlement can one

day be made in Bitcoin — a la conventional banking practice — can overcome

the lack of supply”

– Izabella Kaminska – Financial Times (“The problem with Bitcoin”) – 2013

“So to the extent that the experiment [Bitcoin] tells us anything about

monetary regimes, it reinforces the case against anything like a new gold

standard – because it shows just how vulnerable such a standard would be to

money-hoarding, deflation, and depression.”

– Paul Krugman (“Golden Cyberfetters”) – 2011

“While Bitcoin has managed to bootstrap itself on a limited scale, it lacks any

mechanism for dealing with fluctuations in demand. Increasing demand for

Bitcoin will cause prices in terms of Bitcoin to drop (deflation), while decreasing

demand will cause them to rise (inflation). What happens in each of these

cases? Let’s start with deflation, because right now demand for Bitcoin is on

the rise. What do people do when they think something’s value will be higher

tomorrow than it is today? Well, they acquire and hold on to it! Who wants to

give up money that’s constantly rising in value? In other words, rising demand

causes demand to rise further. Irrational exuberance at its finest. Deflation

begets deflation, ad infinitum, or at least until something breaks.”

– The Underground Economist (“Why Bitcoin can’t be a currency”) – 2010

Deflation and the deflationary debt spiral

Many economists have been debating the advantages and disadvantages of inflation for decades. Nevertheless, this primary point of contention is one of theory; economists, from differing schools of thought have a variety of views on the topic. It is fair to say that the current economic consensus is that deflation is an undesirable economic phenomenon, while moderate inflation of around 2% per annum is desired. Those with Austrian school leanings, who oppose centrally managing inflation towards a certain positive target, tend disproportionality to support Bitcoin and gold’s somewhat deflationary nature. One of the primary drivers for the negative view on deflation appears to be the 1929 great depression and the idea of a deflationary debt spiral. The theory isthat during a period of economic recession and deflation, the real value of debt increases. Such an increase compounds the misfortunes of an already weak economy. Economist Irving Fisher is often credited with formulating this theory, as a response the financial crises of 1837, 1873 and the 1929 great depression.

Then we may deduce the following chain of consequences in nine links:

- 1. Debt liquidation leads to distress setting and to

- 2. Contraction of deposit currency, as bank loans are paid off, and to a slowing down of velocity of circulation. This contraction of deposits and of their velocity, precipitated by distress selling, causes

- 3. A fall in the level of prices, in other words, a swelling of the dollar. Assuming, as above stated, that this fall of prices is not interfered with by reflation or otherwise, there must be 4. A still greater fall in the net worths of business, precipitating bankruptcies and

- 5. A like fall in profits, which in a “capitalistic,” that is, a private-profit society, leads the concerns which are running at a loss to make

- 6. A reduction in output, in trade and in employment of labor. These losses,

bankruptcies, and unemployment, lead to - 7. Pessimism and loss of confidence, which in turn lead to

- 8. Hoarding and slowing down still more the velocity of circulation. The above

eight changes cause - 9. Complicated disturbances in the rates of interest, in particular, a fall in the

nominal, or money, rates and a rise in the real, or commodity, rates of

interest.

Evidently debt and deflation go far toward explaining a great mass of

phenomena in a very simple logical way

– Irving Fisher (1933)

Is deflation as bad as these critics claim?

To the extent that critics accuse Bitcoin supporters of being economically naive, they may not always be entirely correct or they could be missing some nuances. Firstly, one does not need to be an Austrian economist to question whether deflation (supply cap) is always undesirable. Deflation could be bad in some circumstances, but it may depend on the characteristics of the economy and the type of money used in society. The social sciences are not like maths of computer science, nobody really knows the right answer to a high degree of certainty and opinions in the academic community change over time. Furthermore, economic circumstances can change over time, which

can result in a different set of dynamics, where different inflation policies are optimal. Therefore a hard rule, fixed for all time, such as “deflation is always bad”, may not be the correct philosophy. For example, maybe Fisher’s view on inflation was correct for the economy in the 20th century, however by 2150 technology may have undamentally changed to such an extent, such that another inflation policy may be more appropriate for society.

Bitcoin has different characteristics and the deflationary debt spiral argument may be less relevant

As we explained in part 1 and part 2 of this piece, Bitcoin possesses properties which are fundamentally different to the traditional money used in the economy such as the US Dollar or gold backed systems. Traditional money, such as the US Dollar are based on debt, which is an inherent property of fiat money. Alternatively Bitcoin may have properties which make it resilient to credit expansionary forces, such that the money is not inherently linked to debt. Therefore in the event of an economic crash and deflation, in a Bitcoin based economy, the impact of increases in the real value of debt could be less significant than one may think. This could make the deflationary debt spiral argument less relevant in a Bitcoin based economy. In our view, it is likely

that many of the Bitcoin critics may have overlooked this point when evaluating the disadvantages of Bitcoin’s deflationary monetary policy.

Disadvantages of inflation unique to Bitcoin

In addition to Bitcoin having some potential advantages, which could make it more resilient to the disadvantages of deflation, Bitcoin’s critics may also have overlooked some of Bitcoin’s weaknesses, which may make it more vulnerable to inflation:

• Arbitrary Environmental Damage – Another common criticism of Bitcoin is the environmental damage caused by the energy intensive mining process. Although as we explained in the second part in our series on mining incentives, this issue could be overestimated since miners have a uniquely high level of choice with respect to the

geographic location of their mining operations. This flexibility could reduce environmental damage as miners may use failed energy projects rather than investing in new ones. However, it is still important to note that, the negative environmental damage caused by Bitcoin does seem to be a significant negative externality. Mining incentives are made up of transaction fees and the block reward (inflation). Therefore increasing inflation increases the level of environmental damage and increases the negative externality. If a 2% inflation policy is decided upon, this could mean at least 2% of the value of the system is spent “damaging” the environment per annum. The inflation policy decision is somewhat arbitrary and the more inflation is selected the greater the extent of environmental damage. There may even be parallels here with the existing financial system. The policy of central banks to stimulate the economy, to achieve their inflation targets, could also be said to cause an arbitrarily high level of environmental damage, at least in the eyes of some critics. Although the link between inflation and environmental damage in a Bitcoin based system is more direct and measurable. Instead of continued inflation, in Bitcoin the block reward halves every four years until mining incentives are driven entirely by transaction fees. This means that the level of environmental damage will be driven by the market, in that it could represent the amount that users are willing

to pay for security, rather than an arbitrarily high level of environmental damage which would be the result of an inflationary monetary policy.

• Aligning the interests of miners and users – Miners are currently primarily incentivised by the block reward rather than transaction fees. This results in a number of potential problems in the ecosystem, for example perhaps the interests of miners and users are not well aligned. Miners could, for example, exclude transactions from blocks, against the interests of users. Miners may be less likely to take this kind of action if they are primarily incentivised by transaction fees, something Bitcoin’s deflationary policy ensures will eventually become reality.

• Inability to generate coin value – The supply cap can be considered as a key selling point of Bitcoin for investors and is likely to have helped generate investor interest which may have been necessary to bootstrap the system. If a perpetual inflationary policy was chosen, Bitcoin may not have been able to succeed to the extent it has, even if the deflationary policy is inferior from an economic perspective

The irony of this debate – economic criticisms are only relevant if Bitcoin is a tremendous success

Much of this discussion focuses on the economics of Bitcoin, assuming Bitcoin is widely adopted, such that the inflationary dynamics have an impact on society. In our view this is an unlikely outcome and perhaps should be considered even more unlikely by Bitcoin’s critics. In our view, Bitcoin may satisfy a useful niche, that of making both censorship resistant and digital payments, but it’s unlikely to become the main currency in the economy. Therefore the debate about Bitcoin’s deflationary nature should be considered as largely irrelevant anyway. Hence it is therefore somewhat odd that some critics use this as an argument against Bitcoin. This point is similar to one Paul Krugman made in his 2013 “Bitcoin is Evil” piece. Although Mr Krugman is widely derided in the Bitcoin community, most notably for his 1998 comment that “by 2005 or so, it will become clear that the Internet’s impact on the economy has been no greater than the fax machine’s”, we consider the distinction he draws in the quote below as both accurate and sensible:

“So let’s talk both about whether BitCoin is a bubble and whether it’s a good

thing — in part to make sure that we don’t confuse these questions with each

other.”

– Paul Krugman – “Bitcoin is Evil” – 2013

Perhaps Satoshi thought that having a finite supply cap and a deflationary bias, may help the system succeed, even if from society’s point of view, moderate inflation would be more utilitarian. From a system design perspective, producing a working payment system should be the priority, since a system which does not succeed, even if it’s hypothetically beneficial to society, is ultimately useless.

Conclusion

We conclude that rather than being driven by economic naivety, some Bitcoin supporters may have had a more nuanced understanding of the relationship between debt, deflation, the properties of money and credit expansion than the critics think. In contrast one could argue it’s the economic mainstream’s lack of understanding of the relationship between money and debt, and the potential ability of Bitcoin to somewhat decouple the two, which is the most prevalent misunderstanding. Indeed to many, Bitcoin’s ability to decouple debt from money and thereby result in a deflationary climate without the deflationary debt spiral problem is the point, rather than a bug.

However, even if Bitcoin has solved this economic problem, perhaps it’s naive to think Bitcoin would result in a more prosperous economic system. Bitcoin is a new and unique system, which is likely to cause more economic problems, perhaps unexpected or new ones. After all there is no perfect money. It just may not be correct to apply the traditional economic problems of the past, to this new type of money. Although it may be more difficult, identifying Bitcoin’s potential economic problems may require more analysis and a stronger understanding of the underlying technology.

Ironically, if one thinks these economic problems associated with deflation have a remote chance of being relevant, like the critics indirectly imply, that would mean Bitcoin has a significant chance of becoming widely adopted and hugely successful. In that case, perhaps the sensible thing to do is buy and “HODL”.

Voor meer informatie:

Bron:

Gerelateerde artikels: